Covering AMD, SLV, AMZN, and NIO for the short and longer term. Will be adding more posts as we go. Before we go through this, this is not financial advice and I am not responsible for any trades or stocks going up, down, sideways, backwards, or anything of the sort. This is just a breakdown of what I have seen in my charts.

For AMD, we have another bullish setup after our last one triggered. We had perfect entries at the lower trend-line, adding into the volume boost through the larger trend line and maxed out our measured move to 85.

Now we are in the wait and accumulate game. Volume on the sells aren’t so high, MACD has flipped, and Stoch RSI is turning ot the upside. We are looking to break 85.22 on volume and move into the 87 range. Once at 87, if we break that, you are looking at the fib extensions, 89.84 (1.236 extension), 91.49 (1.382), then if we STILL have gas somehow, 94.14 (1.618 extension). Will update as we go.

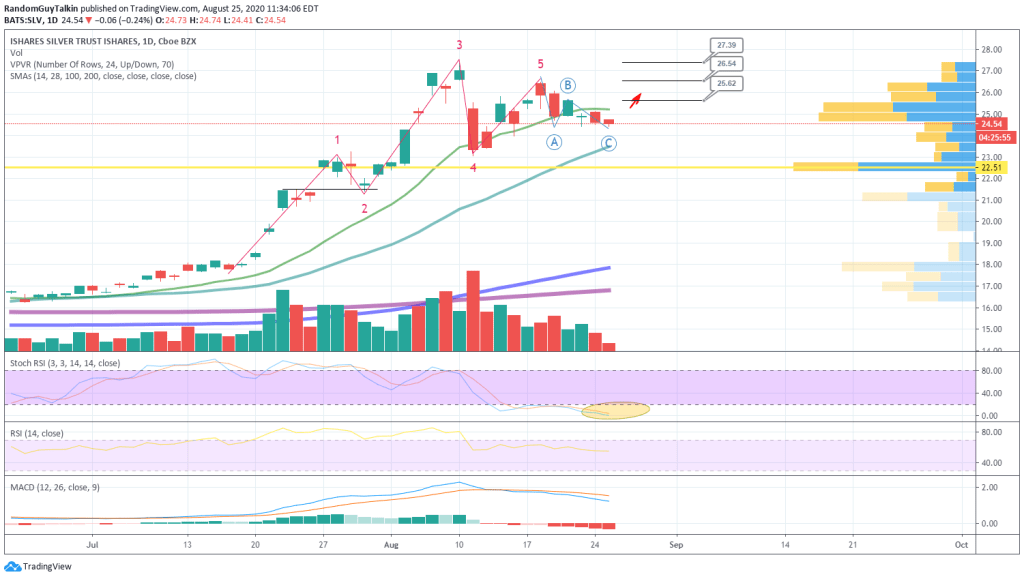

For SLV we are looking at another move post correction. It seems we have cleared the 1-5 ABC correction and are setting up for another move just in time for JPOW to shill how we want inflation (but what we have is stagflation wtf? anyways…). SLV is mainly in the accumulation phase.

Looking for volume and for the Stochastic RSI to flip to the upside, while MACD also flips. Slope is slowing, volume on the corrective C is much lower, so you are looking at a movement upwards as sellers dry up.

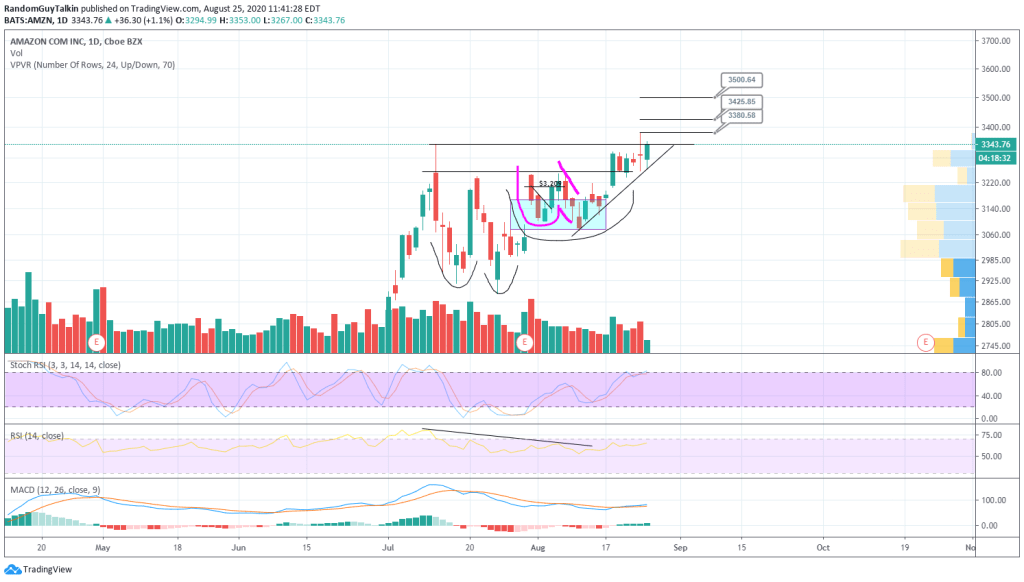

For AMZN we are looking at all the setups it gives us. We caught moves from the cup and handle on the smaller time-frames while keeping the big picture out in front. Looking at a break of this 3340 area on strong volume to hit 3380.58, 3425.85, 3500.64.

We had a decent RSI breakout to the upside which has held, MACD reversal which has held, but stoch. RSI is quite high. We are looking at a breakout or a failure, and with how extended we are as a market, we could be looking at more consolidation. I wouldn’t bet on that though, as my view is that AMZN has to make a decision. Either yesterday was a false breakout and AMZN takes a dip back to 3220 and below, or we push higher, and fast. Maybe a stock split to save the Nasdaq, alla TSLA and AAPL.

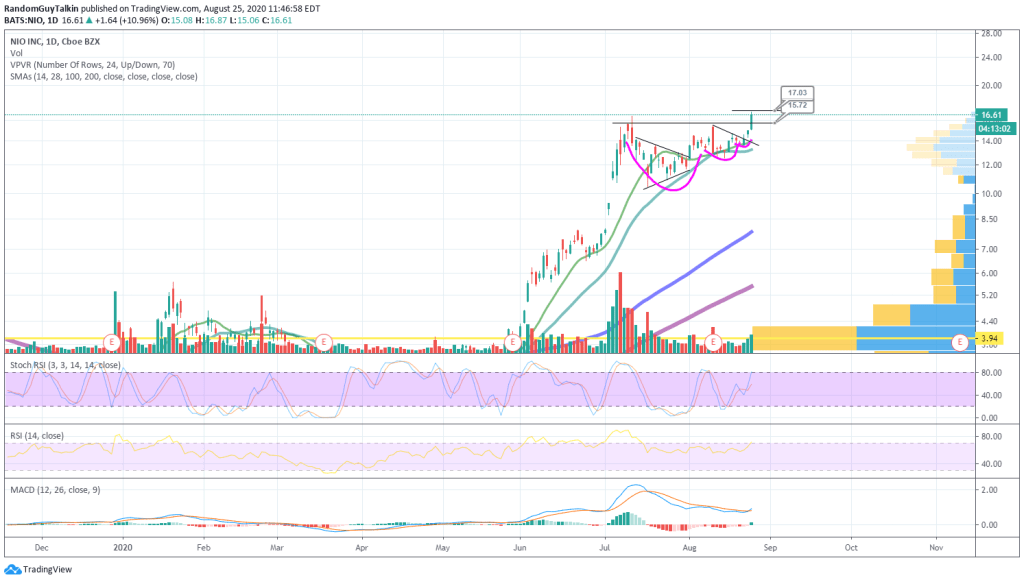

For NIO we have been watching this for quite a while. We had the measured move breakout into the $16+ area and are looking for it to consolidate for a day or two before pushing that $17 zone. Mind, as volume is snowballing and a lot of consolidation, you could see a push to the $20 area as we have a euphoric EV business that brings in everyone who has seen Tesla’s growth.

MACD flip and RSI pushing up, could see a lot more steam still as we are early into the move, but watch for the key breakthroughs. I’ve already trimmed what NIO I had, as I was looking at it from a bit earlier. Will likely re-enter on 17 volume break.